The Benefits of B2B BNPL for small business

Introduction: Unveiling B2B BNPL and Its Advantages

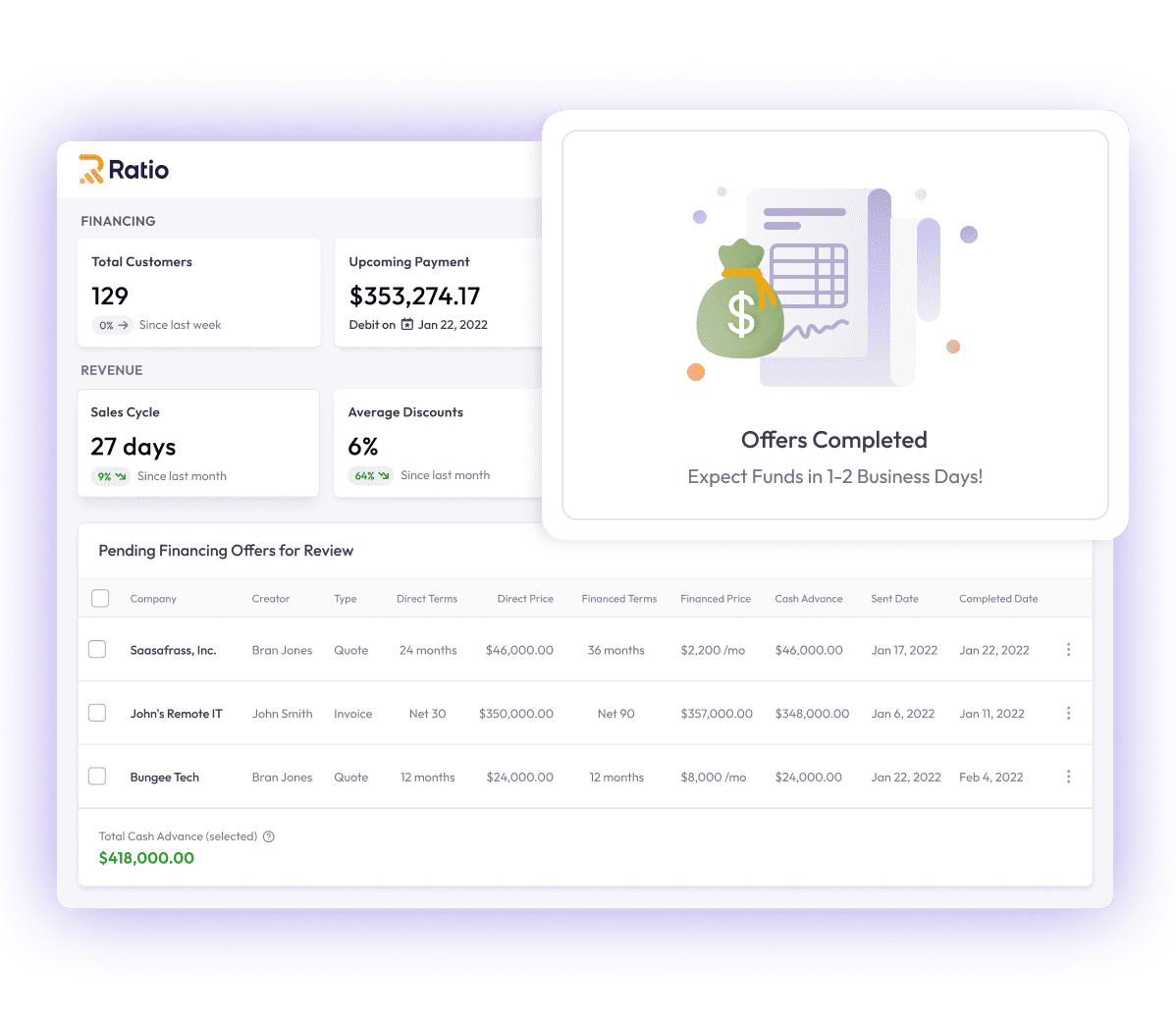

Buy Now, Pay Later (BNPL) is transforming business payments by offering an innovative solution for companies to manage cash flow and drive growth without relying on traditional financing methods. Victor Thu, Ratio Tech's Chief Marketing Officer, sheds light on how B2B BNPL fills a crucial gap in the market, particularly benefiting small tech companies by simplifying the financing process and providing them with a competitive edge.

Benefits of B2B BNPL for Small Business

Unlike traditional trade credit, B2B BNPL provides a win-win scenario for both buyers and sellers. Sellers receive immediate payment, mitigating the risk of late or missed payments, while buyers enjoy flexible payment terms. This setup not only streamlines the sales process but also significantly reduces the administrative burden associated with managing invoices, making it an ideal solution for small businesses looking to expand their purchasing power without compromising their working capital or credit limits.

The Role of Ratio Tech in Revolutionizing B2B BNPL

Ratio Tech pioneers in the B2B BNPL space by offering a service that eases the financing burden for small tech companies, allowing them to focus on innovation and growth. By eliminating the need for internal credit scoring or collections, Ratio Tech ensures that tech companies can offer flexible payment options to their customers effortlessly. This approach not only accelerates sales cycles but also increases the average contract value (ACV) and fosters customer loyalty.

Impact of B2B BNPL on SaaS and Tech Companies' Cash Flow

For SaaS and tech companies, B2B BNPL is a game-changer. It allows these companies to maintain upfront payments without resorting to heavy discounts to attract buyers. Moreover, BNPL facilitates a more predictable cash flow, enabling better financial planning and investment in growth initiatives. As highlighted by Victor Thu, BNPL solutions make it easier for companies to offer hardware as a service, transforming significant upfront capital expenditures into manageable, recurring payments in the following interview:

“Many people are familiar with the consumer side where you go buy stuff online for your appliances or a TV where you can use mechanisms to pay over a period of time, but this mechanism isn't as readily available from the B2B side which is where Ratio Tech comes in. If we look at larger tech companies, they typically have different financing vehicles including financing it on their own books or utilizing distributors or resellers to help financing to buyers of smaller companies. Ratio Tech helps smaller tech companies to be able to provide that financing mechanism so these smaller companies that are growing don't have to worry about the complexity of having to deal with financing of finding different options to help their buyers buy products. Instead they utilize this payment service from Ratio Tech to do BNPL and we help facilitate the transactions on behalf of the buyers and the sellers.”

Exploring Revenue Based Financing: A Complementary Solution

B2B BNPL not only provides immediate financial benefits but also complements revenue based financing (RBF) solutions. By offering instant payment options and protecting against invoice defaults, B2B BNPL solutions enable businesses to leverage their sales without the traditional risks associated with credit. This synergy between BNPL and RBF creates a robust financial ecosystem that supports the dynamic needs of small businesses and tech companies.

Navigating the Future with B2B BNPL: Trends and Predictions

As the business e-commerce landscape continues to evolve, B2B BNPL stands at the forefront of financial innovation. With advanced technologies like machine learning, BNPL providers are set to make more responsible and efficient underwriting decisions, further enhancing the appeal of BNPL solutions. The future of B2B payments lies in simplifying transactions, fostering responsible spending, and supporting business growth through flexible financial solutions like BNPL.

Conclusion

B2B Buy Now, Pay Later is more than just a payment option; it's a strategic financial tool that empowers small businesses and tech companies to thrive in a competitive marketplace. By offering immediate benefits, streamlining sales processes, and supporting cash flow management, B2B BNPL solutions like those provided by Ratio Tech are paving the way for a new era of business financing. As companies navigate the complexities of growth and innovation, embracing B2B BNPL could be the key to unlocking their full potential.

Introduction: Unveiling B2B BNPL and Its Advantages Buy Now, Pay Later (BNPL) is transforming business payments by offering an innovative solution for companies to manage cash flow and drive growth without relying on traditional financing methods. Victor Thu, Ratio Tech's Chief Marketing Officer, sheds light on how B2B BNPL fills a crucial gap in the…

Recent Posts

- Expert Cleaners Lexington Shares Essential Tips for Properly Cleaning Hardwood Floors

- Affordable Fencing Solutions: Fence Company Rochester NY Offers Insight on the Cheapest Fence Installations in Rochester, NY

- Exploring the Drawbacks of Duct Cleaning: Insights from Air Vent Cleaning Charlotte

- Clearing the Dust: Duct Cleaning Louisville KY Shares Tips to Make Your Home Less Dusty

- Landscaping Corpus Christi: Your One-Stop Solution for Superior Landscape Design and Lawn Care Services